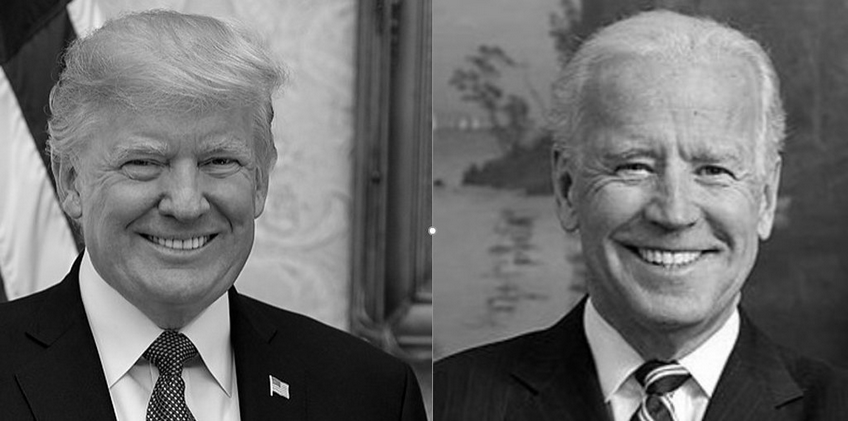

How Might the 2020 Presidential Election Affect the Markets? Retirement Investors Weigh In

“How is politics going to affect my retirement?” It’s a question that is on many retirement savers’ minds, especially as the 2020 election draws closer.

“How is politics going to affect my retirement?” It’s a question that is on many retirement savers’ minds, especially as the 2020 election draws closer.

Recently, Global Atlantic Financial Group put out a survey asking people about their thoughts on the presidential election – and what it might mean for market volatility.

Many retirement investors from across the country weighed in. They talked about their expectations for market performance, election effects on their retirement, and what actions they were taking to prepare for any “spillover” from the election.

Here’s a sum-up of what Americans are thinking about the 2020 election, their retirement, and any potential changes to their financial strategy.

What Do You Think the Market Will Do?

One-third of retirement investors expect “very substantial” market volatility. Meanwhile, nearly 6 in 10 (59%) expect “some moderate” ups and downs in the market.

Almost half (45%) said the winning party would affect their retirement strategy. Another quarter (23%) said the elected party wouldn’t affect their strategy at all. 32% said “maybe,” the winning party might.

Will the 2020 Election Cause You to Change Your Retirement Strategy?

Coronavirus and the uncertainty surrounding it has led to sizable downshifts in the market. It even caused record market losses in the week of February 24-28.

But even so, retirement savers were already a little spooked about what the 2020 election might bid for their retirement portfolios. Even in spite of the market gains from 2019, many people were planning to change up their portfolio mix in lieu of the election.

Almost half (45%) of respondents had or were planning to shift their money into more conservative instruments. Among this group, 21% had already shifted to a more conservative allocation mix.

Another 24% mentioned they were planning to go more low-risk. One in 10 retirement savers (12%) had bought an annuity in anticipation of the election. Another 12% were planning to purchase an annuity in the next 12 months.

What Are Your Top Concerns?

For retirement savers, the top concerns relating to retirement planning included the economy, healthcare, and government dysfunction. U.S. trade and tariff policies, immigration, and border security rounded up the three remaining of the top six concerns relating to retirement. A breakdown of the overall concerns is below, courtesy of Global Atlantic.

The survey was conducted by Artemis Strategy Group for Global Atlantic and covered 1,004 interviewees. The respondents were between ages 40-74, had a minimum of $75,000 in investable assets, and had involvement in their households’ key long-term financial decisions.

What Can You Do to Protect Your Retirement?

Are you concerned about the impact of the election on your money? If you are nearing retirement and want to add more predictability and stability to your financial situation, then take note.

You might consider a fixed index annuity as part of your assets. A fixed indexed annuity offers protection from market losses, growth potential from interest tied to an underlying index, and the certainty of a guaranteed income for as long as you may live.

When the underlying index goes down, your annuity’s value stays flat for that period. In other words, you earn zero interest, meaning your principal and your already-earned interest is locked in. When the index goes up, you earn some interest based on a portion of that growth.

But you can never lose even a penny due to market declines. Hence your money is quite safe there.

How Do Life Insurance Companies Protect Your Money?

This is because fixed index annuities aren’t ever a direct investment in the market. Instead, life insurance companies invest the bulk of index annuity premium dollars in low-risk instruments. Most of these assets are Treasury notes and high-quality corporate bonds.

From there, how does the insurance company offer you the growth potential tied to an index? By committing 3-5 cents of every annuity premium dollar to buy call options on the annuity’s underlying benchmark index.

The remaining dollars go into conservative, low-risk assets.

What Can a Fixed Index Annuity Do for You?

Indexed annuities offer many benefits to retirement savers. One of the chief advantages that these contracts offer is their reset feature.

All indexed annuities have crediting terms, and people can choose what term they want. It could be monthly, annually, or biannually, depending on the annuity owner’s objectives.

But regardless of the length of the term, the contract will reset at the end of the term. This can greatly increase the growth of your money over time.

How a Fixed Index Annuity Earn Interest?

The following example shows how this works. A retiree buys an indexed annuity with the Standard & Poor’s 500 Index as the underlying benchmark. They also choose the one-year point-to-point reset feature.

If the index rises from 2000 to 2300 during the year, our retiree will earn interest based on a portion of that increase. But if the index loses the same amount during the year, then they will earn nothing.

But then when the contract resets, the new beginning point will be at 1700 instead of 2000. So if the index climbs back to 2000 in the following year, then the annuity will still earn interest based on a portion of that growth.

Here is the beauty of this. The retiree doesn’t have to wait for the index to reach 2000 again before they can start earning interest again.

This is a great protection feature that stocks and mutual fund investments don’t have. In fact, they must surpass their previous highs in order to make up for losses.

Keep in mind, though, life insurance companies have some controls over how much your annuity might grow, in exchange for this protection. They can control how much your money might grow with participation rates, caps, or spreads.

Ask your financial advisor or annuity agent for more details on any index annuity contracts you might be exploring.

Receive an Income That Lasts as Long as You Live

Fixed index annuities can also pay out guaranteed streams of income in the same manner as any other type of annuity.

A range of payout options are available, from ones that last for a certain timespan to the rest of your life. You can also request that you and your spouse receive guaranteed monthly paychecks from the insurance company for the rest of your lives.

If you have need for liquidity besides what you would receive from your monthly income payments, no sweat. These annuities also come with a “free withdrawal” feature that allows you to take a portion of your money out as needed.

Ready for More Financial Peace of Mind?

A fixed index annuity can do much good for your retirement, helping bring more stability and certainty to your portfolio. Do a full sweep of your existing financial strategy and see where gaps are. Then ask your financial professional about how a fixed index annuity can solve those problems and bring you more peace of mind.

Your advisor can give you more information on how to protect your retirement portfolio from market turbulence that stems from the upcoming election. You can gain peace of mind knowing that your money is safe, regardless of who gets elected.

If you are searching for an experienced financial professional to help you, look no further. Connect with us directly at 480-607-1346 or 888-416-(LIFE).